Should You Form Your New Company in Delaware or Closer to Home?

Founders of new companies often ask whether it makes sense to form their new company in Delaware, rather than in the state where they plan to operate. Delaware has a lot going for it (I may write about that later), and it’s considered a prestigious address for any company. But it’s difficult to make the case that the Delaware General Corporation Law is so superior to your local state corporation law, at least where start-ups are concerned, that you should make these big factors in your decision. This is what I tell my clients: It depends. It’s purely a cost question, in my view. If you plan to have venture capital firms invest in your company, they will certainly demand Delaware. If you plan to have angel investors (wealthy individuals) put money into your company, they will probably demand Delaware. When you close on your first investment from either a VC firm or one or more angels, you can reincorporate in Delaware then. This is done, in most cases, by forming a new company in Delaware and merging your existing corporation or LLC into it. But does it make sense start in Delaware, and avoid the trouble of reincorporating later?

Not if you don’t plan to seek out new investors who will demand Delaware. And not if you expect many years to pass before you bring in these picky new investors. The deciding factor is cost – and we’re not talking about big dollars here, but for many people it matters.

Generally, it’s cheaper to form and maintain a corporation in the state where its office is located, for the simple reason that companies have to register in the states where they do business, if they are organized somewhere else. (What do I mean by “doing business?” It’s a legal question that's more complicated than it probably should be, surely a good subject for a later blog entry, but certainly having a headquarters somewhere will require registration there. Having employees in a state will also require registration.) If you operate your business outside Delaware, any state where you operate will require you either to incorporate there (or form your LLC there) or to qualify there as a “foreign” business – in this case, “foreign” means from another US state. So, for example, a Massachusetts-based business that incorporates in Delaware has to make filings, pay fees and pay minimum franchise taxes every year in both states. In many states, the initial and annual fees for “foreign” companies are just as high as the fees for locally-formed companies. On top of that, a company not operating in Delaware will have to pay a service company in Delaware a few hundred dollars a year to be its registered agent.

The initial paperwork and fees, with annual reports and more fees every year, for foreign qualification are somewhat comparable to the paperwork and fees for being incorporated there. So unless your business is located in Delaware, incorporating there means you’ve got to send paperwork and fees to two states instead of one. Why do that to yourself unless your investors require it?

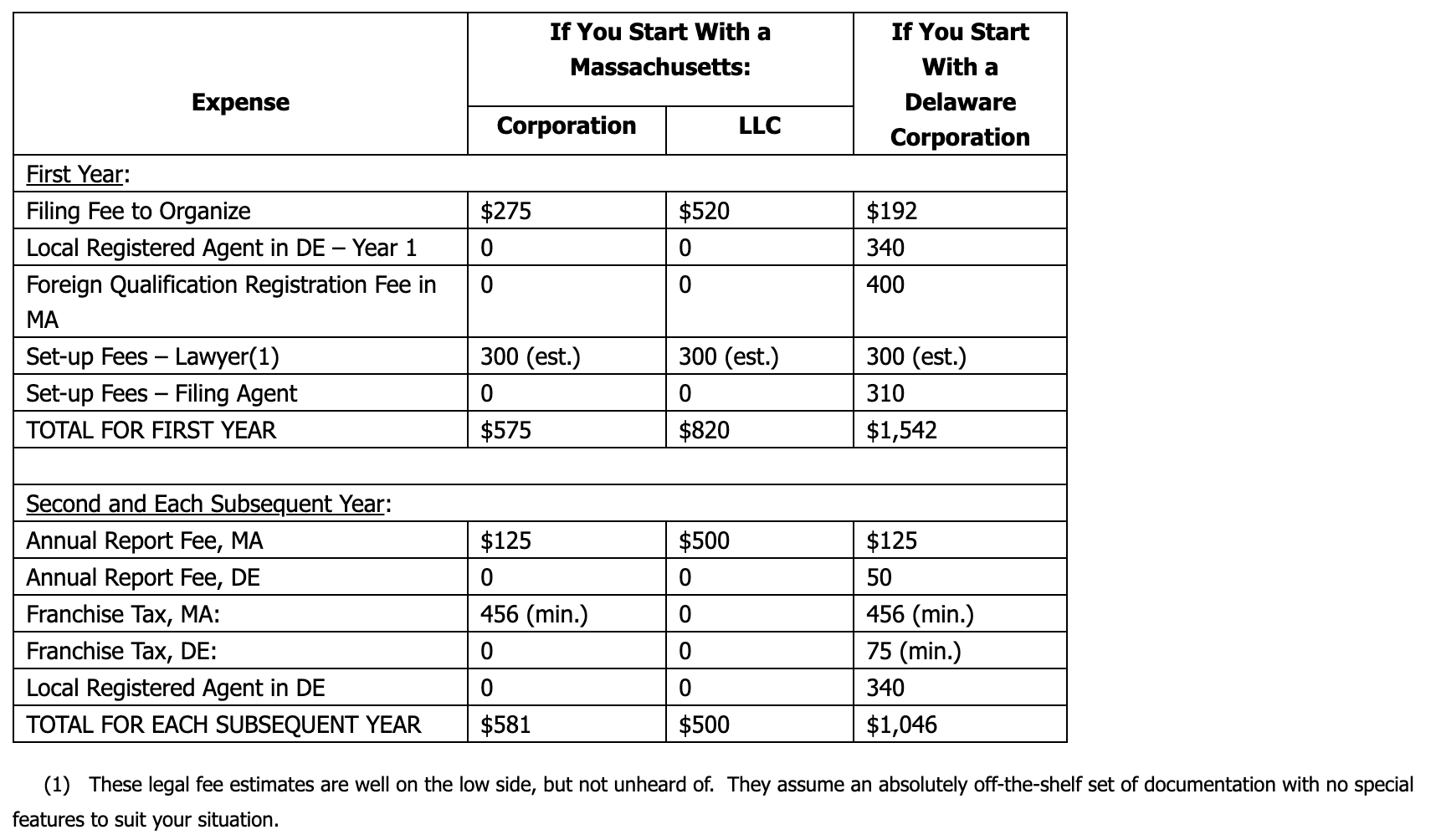

The chart on the next page compares the cost differences between starting in Massachusetts, where I practice, and Delaware, for a company that's based in Massachusetts.

So for a Massachusetts-based business, incorporating in Delaware costs nearly three times as much as incorporating at home. And each year it costs about twice as much to cover the annual fees and franchise taxes. Over time, these differences add up:

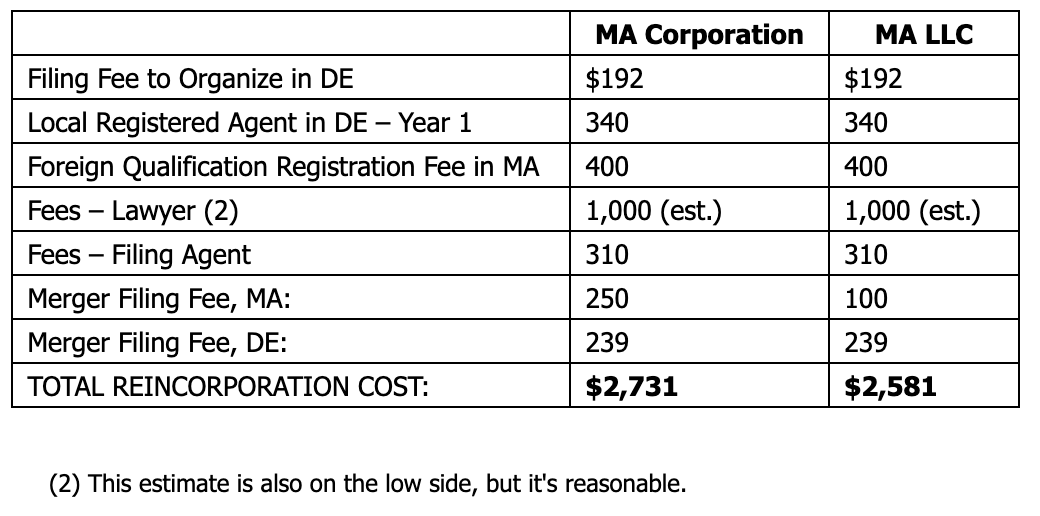

One day you may decide to reincorporate in Delaware. Those costs would run something like this:

And here you begin to see a fairly precise answer to the original question. It costs about $2,700, and probably a little more depending on your legal expenses, to move from Massachusetts to Delaware. You will save about the same amount if you run your company as a Massachusetts corporation or LLC for about 4-5 years, compared with Delaware. So if you believe you’ll need to have a Delaware corporation before that 4- or 5-year break-even point, it makes sense to start in Delaware.

If your company is based in a state other than Massachusetts, or if you are doing business, and have to qualify, in several states, then these numbers will be different for you. But you can use this as a framework for making your decision.

Of course, if cash is especially tight at the start, you could choose your home state even when you expect to move to Delaware soon – by then, the cost of reincorporating will be just a small part of your deal expenses. Don’t forget to make sure the name you use is available in Delaware; there are no guarantees it will stay available until you’re ready to move, but presumably you’d like to know if the name is already taken. And if you don’t think you’ll ever have investors pushing you to form your company in Delaware, you don’t need to do any of this math. Don’t feel compelled to go there.

(1) These legal fee estimates are well on the low side, but not unheard of. They assume an absolutely off-the-shelf set of documentation with no special features to suit your situation.

So for a Massachusetts-based business, incorporating in Delaware costs nearly three times as much as incorporating at home. And each year it costs about twice as much to cover the annual fees and franchise taxes. Over time, these differences add up:

© 2014 by Robert G. Schwartz, Jr. All rights reserved Disclaimer: This summary is provided for educational and informational purposes only and is not legal advice. Any specific questions about these topics should be directed to an attorney.